When price makes a new high but RSI makes a lower high, it could signal weakening upward strength.

When price makes a lower low but RSI makes a higher low, it could indicate hidden bullish strength.

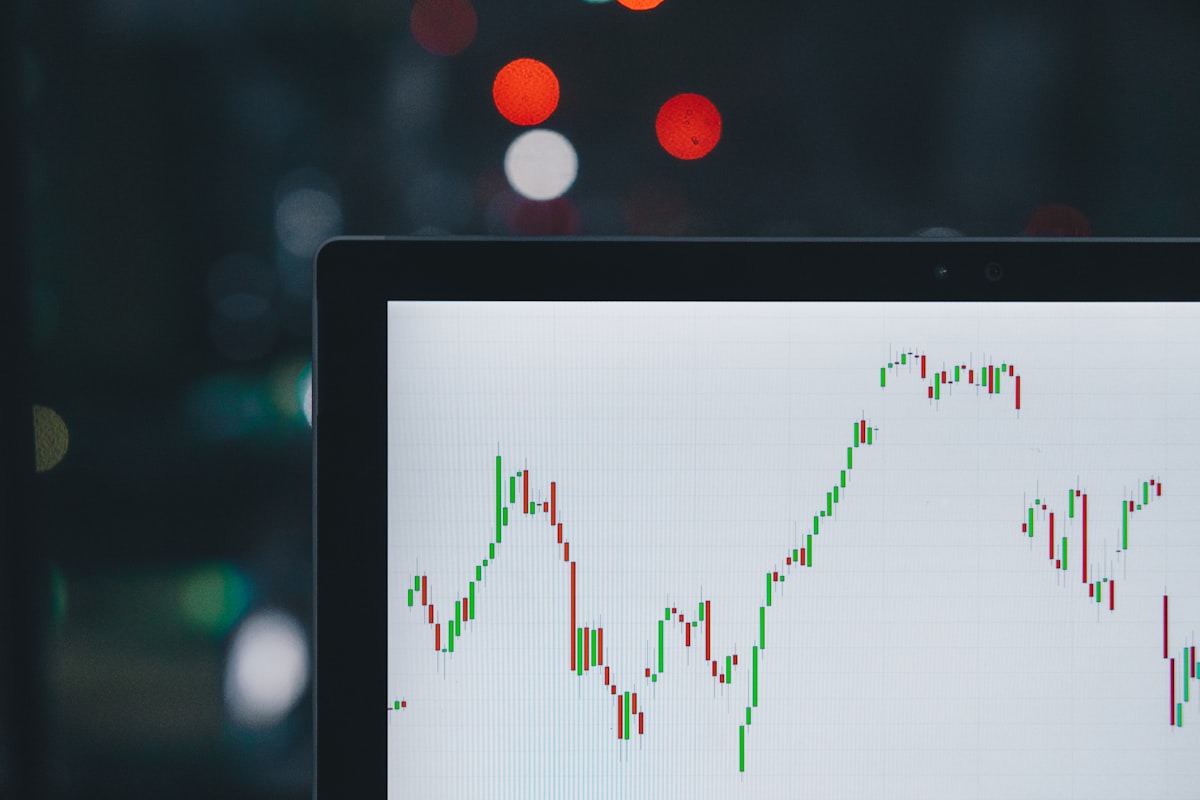

A chart showing RSI climbing above 70 while price forms a sharp upward move, suggesting the move may soon slow or consolidate.

A chart where RSI dips below 30 and the price stabilizes or begins to rise afterward, showing buyers returning after a selloff.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It provides a visual guide to determine whether an asset is gaining strength or losing it.

Setting up RSI on TradingView is simple and user-friendly:

Open any asset chart (crypto, stocks, forex, etc.).

Click the Indicators button at the top of the screen.

In the search bar, type RSI and select "Relative Strength Index."

RSI will appear as a separate graph below your price chart.

The default setting is a 14-period RSI, which calculates momentum over the last 14 candles (bars). You can adjust this to fit faster (7) or slower (21) trading styles.

Once active, you can monitor how RSI moves in relation to the asset's price action. Watch for RSI levels crossing key thresholds (70, 30) or turning points that could hint at market shifts.

Once active, you can monitor how RSI moves in relation to the asset's price action. Watch for RSI levels crossing key thresholds (70, 30) or turning points that could hint at market shifts.

RSI: Your compass in trading. 35 is oversold, time to buy. 75 is overbought, consider selling.

35

Low

75

High

Open TradingView, add the RSI indicator.

Decode RSI.

Master RSI visually

RSI:

Focuses on price momentum to detect overbought or oversold conditions.

Easy to Read

Detects Momentum Shifts

Shows Trend Direction

Suitable for All Assets

Highlights Overbought/Oversold

Good for Beginners

MACD:

Tracks trend direction and momentum shifts using moving averages.

Easy to Read

Detects Momentum Shifts

Shows Trend Direction

Suitable for All Assets

Highlights Overbought/Oversold

Good for Beginners

Moving Averages:

Smooths out price action to highlight trend direction over time.

Easy to Read

Detects Momentum Shifts

Shows Trend Direction

Suitable for All Assets

Highlights Overbought/Oversold

Good for Beginners

Understand bullish momentum.

Identify bearish strength now.

Know when to stay put now.

Avoid false signals always.

Master RSI visually

Grasp the core principles of RSI swiftly and efficiently.

Learn to interpret RSI readings on TradingView like a pro.

Identify overbought and oversold conditions with precision.

Apply RSI in various market scenarios for better decisions.

Combine RSI with other indicators for robust strategies.

Refine your trading approach with RSI insights.

Understand how RSI works and interpret it on TradingView. Learn to identify potential overbought and oversold conditions.

Understand the RSI scale.

Find key levels easily.

Use RSI effectively.

See RSI in action. Refine your skills with practical examples.

Get in touch for personalized guidance.

John Smith

Analyst